This post is very off-topic for me, but I just spent a lot of time trying to figure this out and figured I would make a post here in case it could help someone out in the future. Dig in!

Continue reading “Adding a Private Git Dependency to a render.com Project”Tax Strategy

Tax strategy is one of the three pillars of sound investment strategy, along with minimizing fees, and diversification. In this article, we will explore a wide range of tax-advantaged investment vehicles, including 401(k) and 403(b) plans, IRAs, SEP plans, HSAs, and 529 plans for children. We will also compare and contrast Roth and Traditional tax treatments and discuss advanced strategies such as tax loss harvesting, backdoor Roths, and more. Finally, we will delve into how tax considerations can inform portfolio allocation, including placing higher risk, higher return assets in tax-advantaged accounts and lower returning assets in taxable accounts.

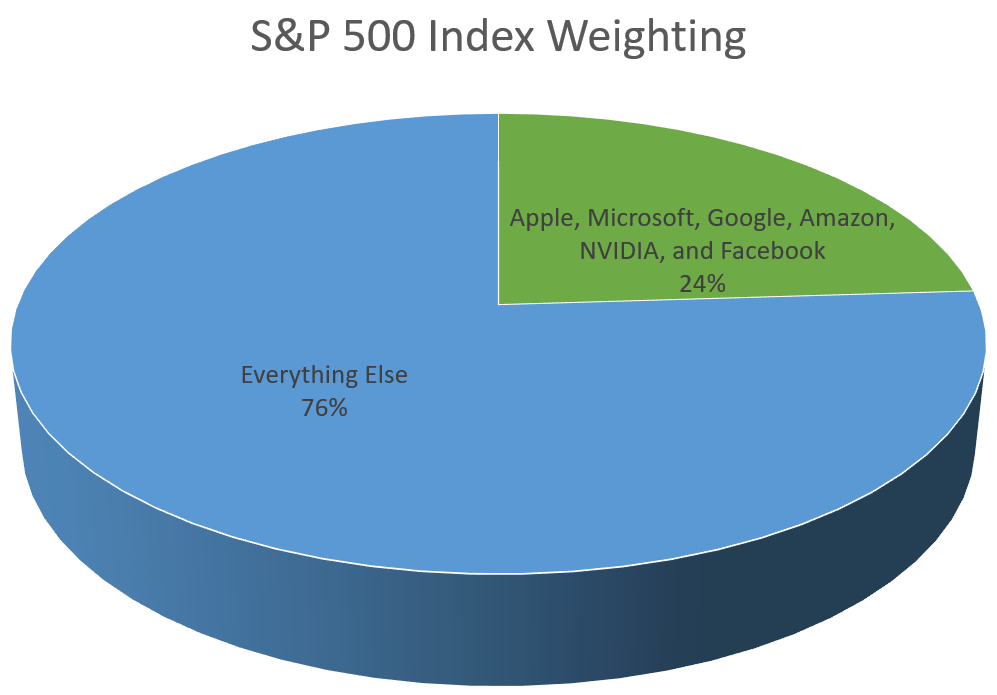

Is the S&P500 Index Actually Diversified?

The S&P 500 index, a widely followed benchmark of the U.S. stock market, has long been considered a reliable indicator of the overall health of the economy. However, a closer look at the index reveals a surprising concentration in big tech stocks. This phenomenon is not only a reflection of the growing dominance of technology companies in the market, but also a result of the market-weighted structure of the index. Let’s explore the reasons behind this concentration and discuss the potential risks it poses to investors.

Backdoor Roth IRA Strategies

For many individuals, saving for retirement is a top priority. One popular savings vehicle is the Roth IRA, known for its tax-free growth and withdrawals. However, not everyone is eligible to contribute directly to a Roth IRA due to income limits. Enter the Backdoor Roth IRA and Mega Backdoor Strategies, which provide high-income earners with an alternative path to tax-advantaged retirement savings. In this article, we’ll explore these strategies, their benefits, and potential pitfalls.