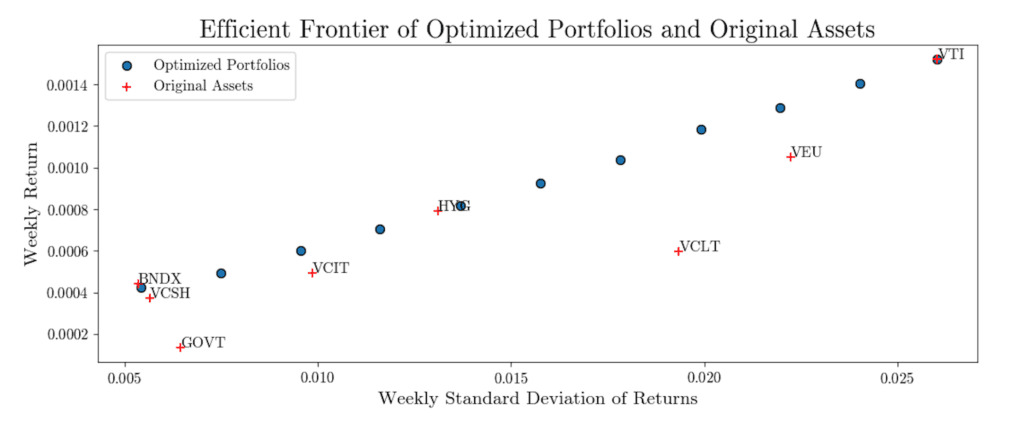

For the past month I’ve been working on a few improvements to the asset allocation model that underpins my portfolio management process at Luther Wealth. I’m really proud of the models currently in place, but I like these new ones even better! I’ve been able to fix some blind spots, and I’ve also been able to avoid some structural problems with one of the equity index funds I have been using. None of these changes are mind-blowing, but I’m proud to work constantly to make small, incremental improvements to my portfolio management process.