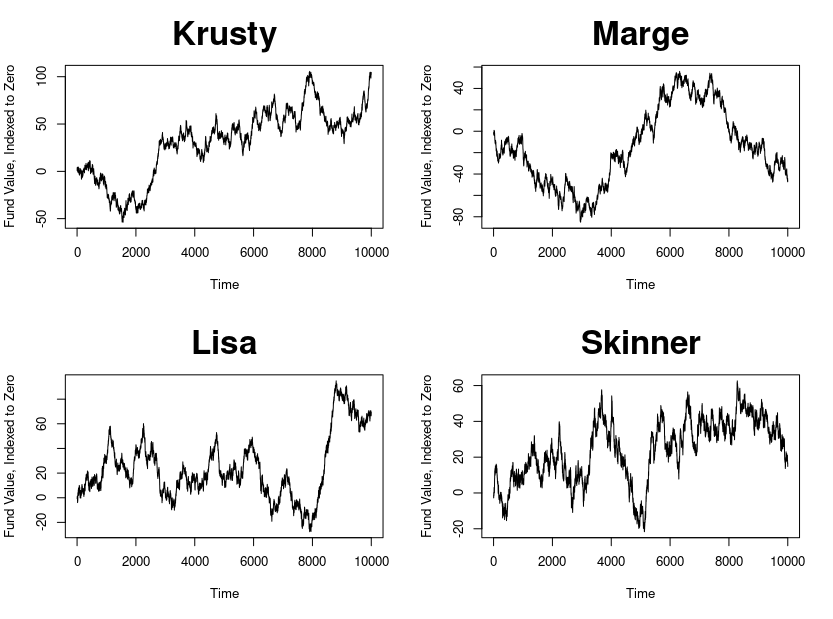

I am a big proponent of passive investing. But, recently, I have been running a little experiment running a paper trading account with actively managed funds. I selected an active fund manager based on the fund’s track record. I thought it would be interesting to walk through how I picked the manager, and then invite you to attempt to pick a manager using the same information I had. Then, I will show you how your pick would have performed. Good luck!

What information am I giving you?

To keep things simple, I limited my available information (and yours) to the prior period fund performance. I won’t tell you what period, or how long the period was. But suffice it to say that I felt the time period was long enough to get a sense of how things were going for each manager. I have also standardized the fund performance to start at zero at the beginning of the period, and have taken the “units” out of the fund returns by normalizing everything to have the same standard deviation. Finally, I anonymized each active fund manager by giving them a code name from The Simpsons.

So essentially, we are going to look at four active fund managers’ prior performance, leading up to the point at which I made my decision to invest. For each manager, I’ll briefly talk through some interesting things I saw, and then you can make your pick before I tell you how it ended up.

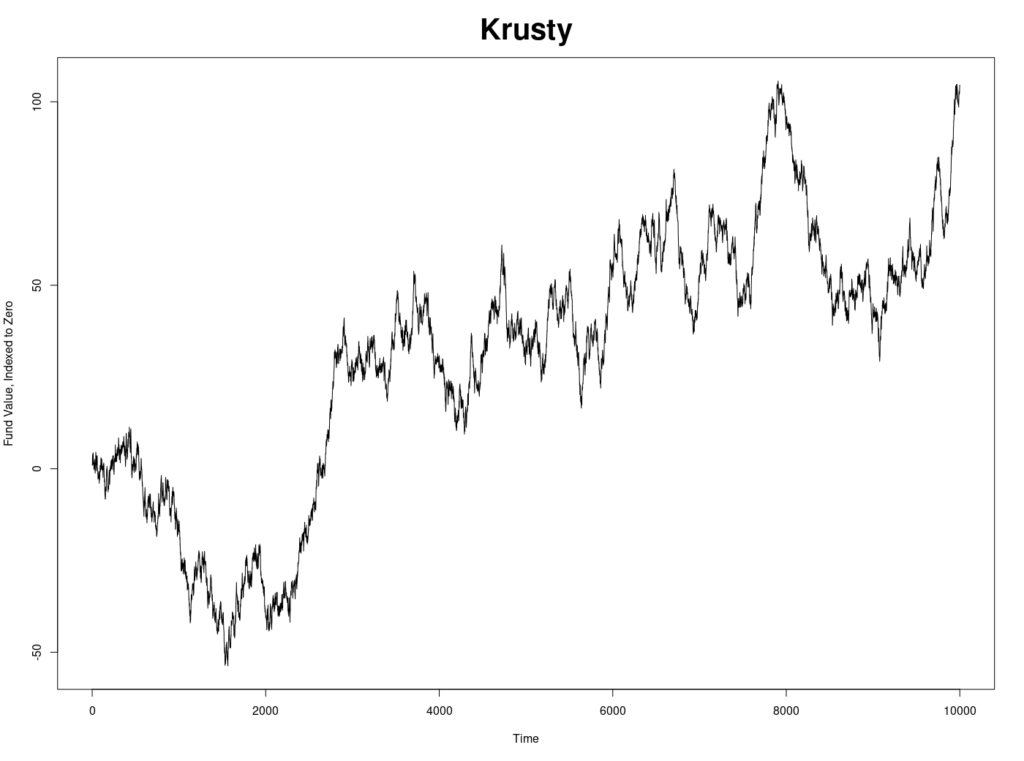

Krusty the Clown

Krusty was consistently making money in our lookback period. Definitely a rocky start, but other than the very beginning of the observation period, Krusty is earning big returns. And not a lot of big spikes or obvious volatility risks. Pretty good right?

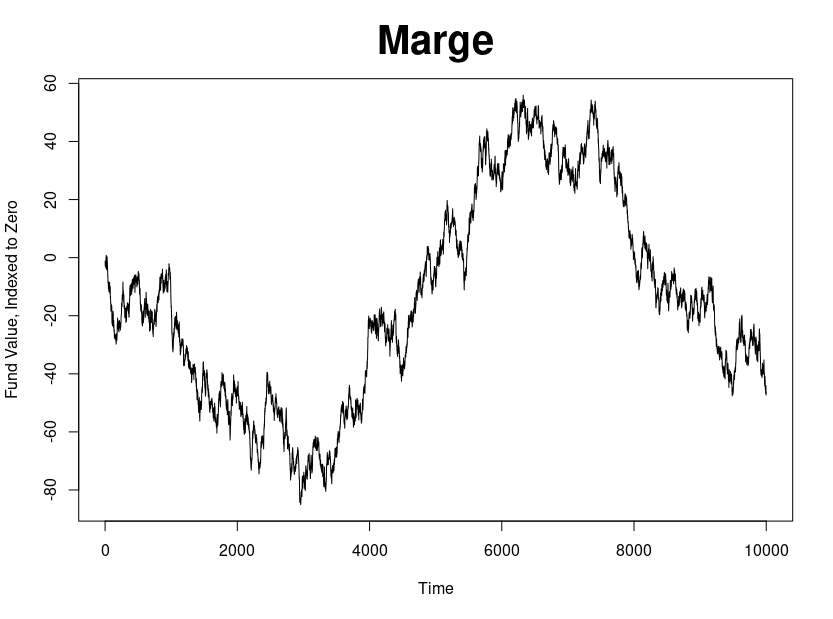

Marge

Marge is much more “all over the place”! During the middle of our time period, Marge really went on a tear. Marge’s middle third of the lookback period was the highest returning section of any of the managers. However, more recently, Marge has been losing massive amounts of money for her shareholders. Based on this data, Marge appears to be a more volatile, risky manager. Although maybe the recent losses are just flukes and her investments are primed to earn big returns based on their low current valuations?

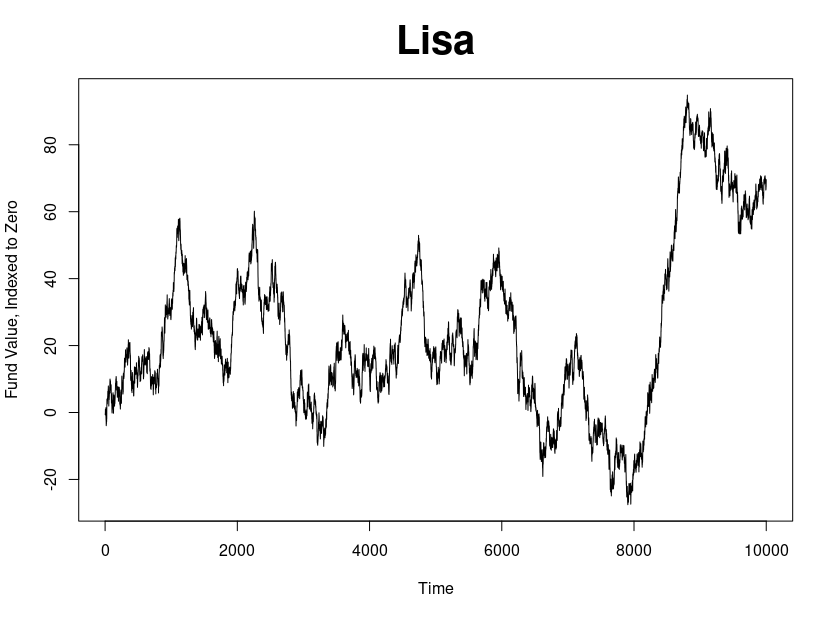

Lisa

Wow! It seems like Lisa figured out a winning strategy right before our decision to invest. Lisa really just treaded water for most of the lookback period, but roughly 2,000 time-units ago, she changed strategies and had the biggest short-term tear of any manager in our slate. But then she went flat again, so it’s not clear if the new strategy stayed good, or if it was just a one-time mispricing. Also of note, she hasn’t had any big downturns over the lookback period.

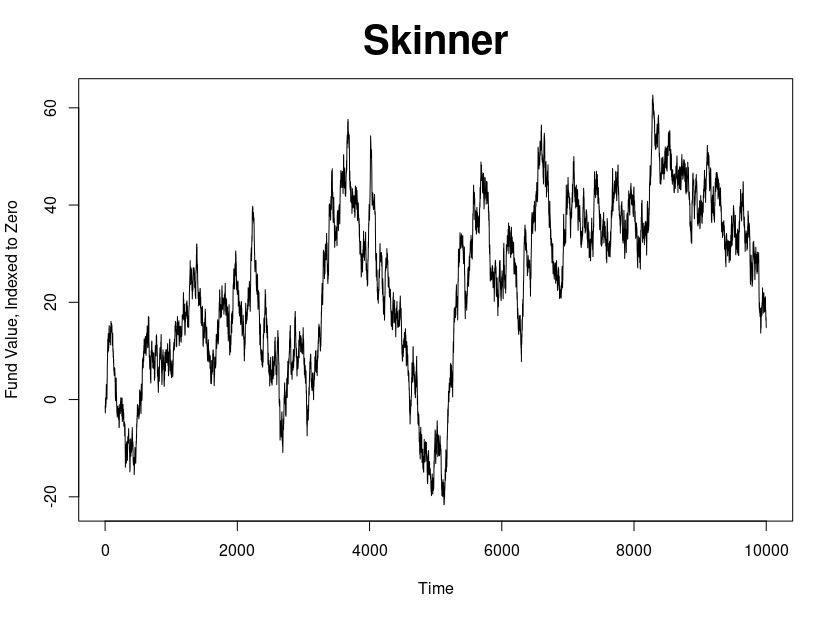

Principal Skinner

The big loss around time period 4,000 is what jumps out at me for Skinner. What the heck happened? Especially since Marge and Krusty had good returns during that period. But excluding that period, Skinner actually has great performance. If you removed that little slice, Skinner would be the top performing manager by far.

So which active fund manager are you going with?

A few hints. I intentionally obfuscated the time period of the lookback period, and even the time length. But, the time measurement was consistent across all 4 active fund managers. So it might help your choice to identify which periods represented overall market strength or weakness. Would you rather have a consistent manager, or a more volatile manager that has a knack for minimizing losses in rough periods? Do you have enough information to make that determination?

And the correct answer is…

I lied! I didn’t pick an active fund manager. Actually, these four performance histories are just four random walks generated with a simple normal distribution (mean = 0, std = 1) for each time tick’s returns. You can reproduce these random walks in R using the following code:

set.seed(0)

Krusty <- cumsum(rnorm(10000,0,1))

Marge <- cumsum(rnorm(10000,0,1))

Lisa <- cumsum(rnorm(10000,0,1))

Skinner <- cumsum(rnorm(10000,0,1))As it turns out, all four managers follow the exact same strategy of taking a random step in a random direction each time tick. I went through this exercise to illustrated how active managers can suck you in with clever marketing and claims of superior past performance. The fact is, if you have a classroom of 30 people compete in a coin flipping contest for a hundred coin flips, a few of them will have really good performance. But this doesn’t mean they are good at flipping coins. Sometimes random walks just happen to walk upwards. I’m looking at you, Krusty.

This exercise also illustrates how we, as humans, can find patterns in things that don’t really have a pattern. If I had more time, I would have fleshed out the analysis of the four fake managers to include a bunch of technical analysis, drawing heads and shoulders on the price charts. Identifying support and resistance levels. But it’s all just random nonsense. There is no underlying performance to identify. It’s just randomness.

Finally, this exercise helps to illustrate that humans aren’t very good at identifying random noise. Each random walk has “features”. There are shapes. Periods of continuous up or down movement. It’s not as “fuzzy” as we expect it to be. In other words, the random walk goes in a straight line more than we expect it to. You can see this in a casino, where gamblers are always freaking out about how many times the dice land on nine or whatever.

TL;DR– don’t be fooled by a nice looking performance history!

Don’t miss out on future posts!

Don’t miss any new posts! Sign up below to subscribe. I generally post once per month and I alternate between longer-form articles and short digests of interesting financial content from other sites I’ve found. Thanks for reading!

Discover more from Luther Wealth

Subscribe to get the latest posts sent to your email.