You’ve probably read some stuff about the yield curve inverting earlier this month. Or at least heard someone talking about it in the last few weeks. What’s up? Is there going to be a recession? What moves should you make with your portfolio to protect yourself?

What is a yield curve, and why is it inverting?

The yield curve is an industry term for talking about how interest rates are affected by the duration of a loan. If you make a chart of the interest rates that banks charge for different home mortgage terms, like 10-year, 15-year, and 30-year, you now have the yield curve for mortgage loans.

There are lots of different yield curves, but everyone is talking about the U.S. Treasury yield curve. The federal government borrows money from lots of sources. If you own a savings bond or have invested in U.S. Treasury bonds, you have lent the U.S. government money. The federal government also borrows from foreign individuals and countries, and global businesses. Basically everyone.

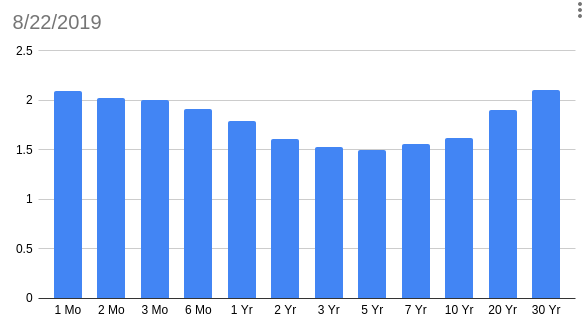

The market for U.S. government debt is the most liquid market in the world, which in most cases means that everyone gets the same interest rate lending to the government, regardless of how big or small you are. These interest rates are public and updated in real time, so you can always check what interest rate that U.S. government debt is trading at. Here’s the current yield curve.

Current U.S. Treasury Yield Curve

This might look a little unremarkable. The interest rates that the government pays on its debt are around 1.5% to 2.0%. But taking a closer look, it should seem unusual that some of the longer maturities carry lower interest rates. There are some complicated reasons for why longer-term debt should have a higher interest rate, but its pretty intuitive. Common sense tells us that if I borrow money for longer, I’m getting a more valuable loan and I should pay a little extra for the privilege. This unusual state is called a yield curve inversion.

So why would an inversion happen?

Lots of different reasons. One possible reason is that investors might expect the whole structure of interest rates to be lower in the future. If you think all the interest rates are going down, you might invest in 1.5% debt that last 10 years, rather than 2.0% debt that lasts 1 year. You might get a higher interest rate with the 1-year bond, but if all rates are 1.0% lower a year from now, you’d be in a jam for years 2 through 10. Better to lock in the 1.5% now if you expect all interest rates to go down soon.

It’s not great if investors think interest rates are going down, because low interest rates are typically a sign of economic weakness.

Sounds scary! What should we do with our savings?

Nothing!! Seriously, don’t change what you’re doing with your money.

I understand the impulse. You have heard (possibly correct) information that yield curve inversions are known as a signal of an upcoming recession. So you want to take your money out of your riskier investments, or possibly even liquidate your whole portfolio and wait out the storm. Or maybe a broker or adviser is calling you and telling you that he or she has a strategy to alter your portfolio to limit “downside risk”.

The problem with reacting to news

Hate to break it to you, but it’s too late to actively adjust. The second that the 2y – 10y yield curve inverted on August 14th, a hundred thousand bond analysts and traders across the world analyzed the risks and re-positioned their portfolios. And in the same instant, equity traders adjusted their bid-ask spreads to account for the new information. And in the moments before that, algorithmic trading robots received the data feed from treasury pricing sources and executed trades to take advantage of the interest rate moves.

Weeks before that, bond market participants understood there was a certain probability of an August inversion, and adjusted their portfolios to account for the approaching risk.

There are 972,000 employees in the U.S. engaged in Securities, Commodity Contracts, and Other Financial Investments according to BLS. And a lot more than that globally. Plus countless automated trading systems. Each of them individually has spent more time thinking about this yield curve inversion than you or I have. And all of their thoughts and analysis are currently reflected in the price of each and every stock, bond, commodity, and asset that you could possibly invest in.

Your portfolio has already adjusted without you doing anything

The good news is that, assuming you had a reasonably diversified portfolio before the yield curve inversion, you are fine! All of those moves that those millions of traders made already, have adjusted prices in your portfolio in a way that reflects the changed risk/reward characteristics of the individual assets.

What probably happened is that some of your riskier assets lost some value. That means that if a recession hits, you have already “pre-lost” some of the hit you would take during a recession. In other words you have already “de-risked” a little.

And if a recession doesn’t hit, you might receive larger than usual returns in a normal, strong economy. So you are being compensated in potential rewards for the risk you still hold.

In other words, the risk / reward outlook of your portfolio is basically the same as it was before the yield curve inversion. If you make a bunch of moves, you are just handing commissions to stockbrokers for no reason. Don’t do that!

Discover more from Luther Wealth

Subscribe to get the latest posts sent to your email.