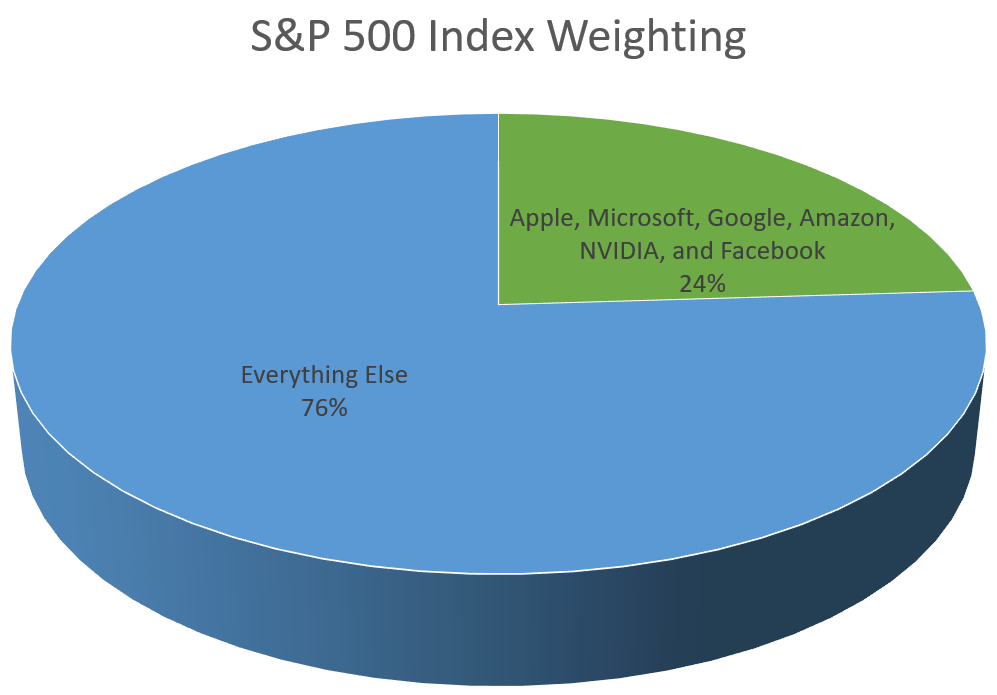

Last year, a fintech company called Synpase went bankrupt, affecting bank accounts of over 100,000 clients. This bankruptcy sent shockwaves through the financial technology sector, raising profound concerns among investors, especially those relying on modern fintech custodians. The key problem is the decision by the Federal Deposit Insurance Corporation (FDIC) not to backstop Synapse’s account holders, a move with significant implications well beyond Synapse itself. This decision raises serious questions regarding investor safeguards and custodial protection mechanisms within the broader fintech ecosystem, particularly for robo-advisors and similar services that have garnered sweeping popularity in recent years.

I’ll go ahead and put my main conclusion at the top for this one. Previously, I have been very positive on robo-advisors for certain clients that are willing and able to self-direct investments. Based on the FDIC response and discussion around Synapse, I don’t think any investors should have any money with robo-advisors. Furthermore, I don’t think investors should use any fintech intermediary at all, at least until the FDIC and SIPC catch up to the times.

Your savings should go directly into a real, regulated bank. Your investments should go directly into a real, regulated custodian. Until the FDIC and SIPC say different, if the people you deal with for customer service aren’t the ones getting audited, you are not protected.

Continue reading “Robo-Advisor Clients Should Worry About Synapse”