This is Part 1 of a series of posts about various cognitive errors that lead to poor investment decisions. Part 1 deals with confirmation bias.

I know that most men—not only those considered clever, but even those who are very clever, and capable of understanding most difficult scientific, mathematical, or philosophic problems—can very seldom discern even the simplest and most obvious truth if it be such as to oblige them to admit the falsity of conclusions they have formed, perhaps with much difficulty—conclusions of which they are proud, which they have taught to others, and on which they have built their lives.

Tolstoy, What is Art, 1897

The average investor isn’t very good at it

The modern middle class investor beginning their retirement savings has full access to the same investments as the wealthiest and most sophisticated investors. Index funds and ETFs provide a cheap way to invest in the vast majority of global liquid assets. This has made the playing field for investing mostly flat, for the first time in history!

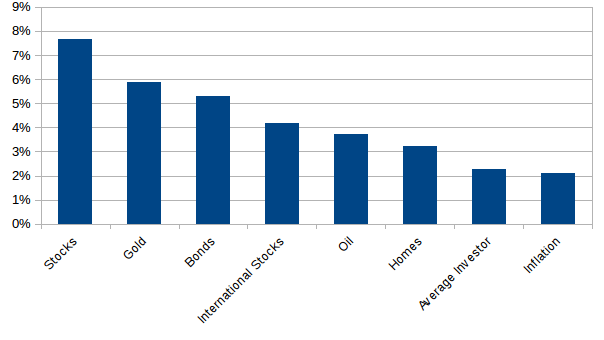

Despite this historically flat playing field, most investors don’t come anywhere close to a “market return”. Blackrock has compiled some data from 1997-2016 showing annual individual asset returns compared to the average investor:

This, by the way, is one of the cornerstones of my investment philosophy. It’s a key difference between a traditional investment adviser and Luther Wealth. Most financial advisers will make some pitch about how their advice will help you beat the market. I commit to helping you achieve investment returns equal to the market return at an appropriate level of risk. This doesn’t sound very exciting, but the fact is, the advisers that promise to beat the market usually underperform and overcharge their clients. So matching the average market return is a huge win for an investor, especially if it can be achieved at a low fee!

Why do investors underperform the market? Cognitive Bias

So how does this poor average performance happen? Even if investors are randomly mixing assets together without a thought, their returns should come close to the average asset return, right? But they actually do much worse than that! In fact, individual investor performance is worse than any other asset Blackrock looked at.

This happens because most individual investors make systematic errors that lead to the worst possible performance. For example– selling assets at the bottom of market dips and buying assets at the peaks of bubbles (ahem… bitcoin). Some of these poor decisions are due to well known cognitive biases. In this series, we’ll take a look at several cognitive biases that influence all investors.

Confirmation Bias

Confirmation bias is the tendency to seek out information that closely aligns with what we already believe, and to avoid information that conflicts with what we already believe. It’s how fake news spreads. It’s how gamblers convince themselves that their system works. This crops up in a couple of ways in investing:

- Overconfidence in your own investing abilities is self-reinforcing. If you think you’re good, you’ll remember your wins and forget your mistakes.

- If you like your adviser/broker, you will remember the good tips and forget the bad tips.

- You adopt investment theories that align with your political affiliations.

- You reject new information that runs counter to any strategy you have previously adopted, and fail to dump losing strategies.

- You invest too heavily in the public stock of your own company. You’re already mentally and emotionally invested in the company being good and successful, so you double-down and over-invest your savings with them. You might have conversations at work about why outside investors fail to see the potential of your company.

Confirmation bias in practice – some current examples

- In 2010, many prominent, politically conservative economists and investors wrote an open letter to Fed Chairman Ben Bernanke advocating against quantitative easing (QE). They argued that QE would not achieve the Fed’s goal of reducing unemployment. Furthermore, they warned the program would cause inflation to rise much higher than the Fed’s 2.0% target. Since then, unemployment has fallen from 9.8% to 3.8%, and inflation has barely risen from 1.5% for 2010, to 2.1% in 2016. It has since hovered around its 2.0% target. Most of the authors of the open letter have not revised their predictions in light of this new evidence.

- A lot of left-leaning investors took money off the table when President Trump was elected and missed out on the huge stock market growth in 2017.

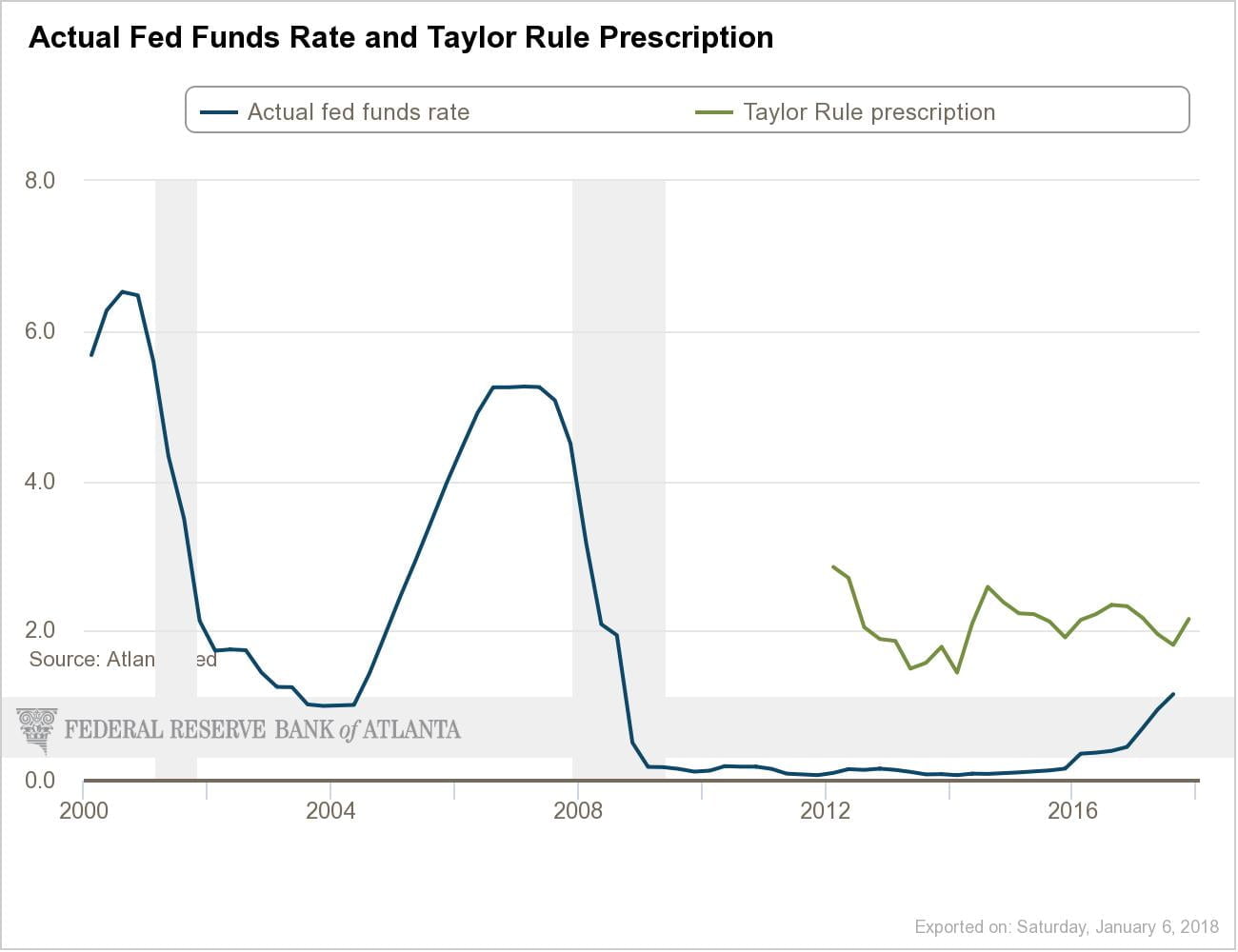

- Personal Example!! I was writing an earlier version of this article around eight months ago. I was going to include a snide bullet about how the “interest rates are artificially low” people tend to ignore economic evidence supporting the suitability of the current low-rate environment. So I went to the Atlanta Fed’s Taylor Rule Utility to pull some supporting data for my argument. I found that I had actually been ignoring at least one datapoint supporting the need for higher rates. Using the implied natural interest rate from the FOMC and a 2% inflation target, the Taylor Rule prescribed interest rate is actually a little over 2%, whereas rates at that time were around 1.5%. I love this. Cognitive bias hits us all.

So what? How can I eliminate my confirmation bias?

You probably can’t! Lol sorry.

That’s why it’s best to stick to simple indexing and diversification strategies that limit the damage your own thoughts and beliefs can do to your investment strategy. Keep it simple– it’s the best way to keep your biases out of the picture!

Keep an eye out for additional articles in our series on Cognitive Bias!

One more quote for the road…

I used to say to our audiences: “It is difficult to get a man to understand something, when his salary depends upon his not understanding it!”

Upton Sinclair, 1935

Discover more from Luther Wealth

Subscribe to get the latest posts sent to your email.

3 Replies to “Cognitive Bias Series: Confirmation Bias”